If you’ve been thinking about growing your money instead of just saving it, you’re not alone. With rising inflation, a fluctuating job market, and an increasing cost of living, investing is no longer a luxury—it’s a necessity.

For beginners, the idea of putting your hard-earned money into the stock market, mutual funds, or real estate can feel overwhelming. Where do you start? What’s safe? How much should you invest?

The good news? You don’t need to be a financial expert or have thousands of dollars to begin. In fact, 2025 has brought more beginner-friendly investment tools and platforms than ever. This guide breaks down 10 smart, low-risk strategies to kickstart your investment journey.

1. Set Clear Financial Goals

Before investing, define your “why.” Are you saving for a home? Planning early retirement? Creating long-term wealth?

Setting clear goals helps determine:

- Your risk tolerance

- Ideal investment timeline

- Asset types to choose

Pro Tip: Break your goals into short-term (1–3 years), medium-term (3–7 years), and long-term (7+ years).

2. Build an Emergency Fund First

Before you invest, secure your foundation. An emergency fund protects you from life’s unexpected surprises—like medical bills or sudden job loss.

Recommended amount: 3 to 6 months of essential living expenses

Where to store it?

- High-yield savings accounts

- Liquid mutual funds

- Money market accounts

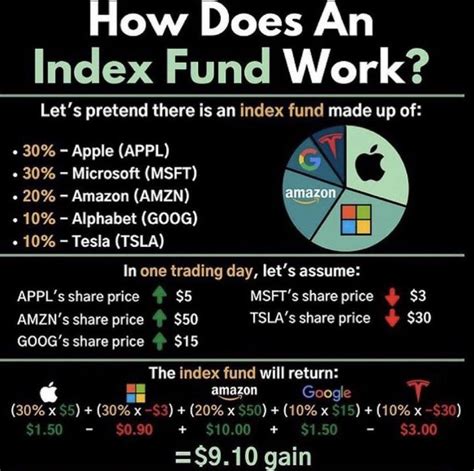

3. Start with Index Funds or ETFs

Don’t try to pick the next Amazon. Instead, start with index funds or exchange-traded funds (ETFs)—diverse bundles of stocks that track a specific index like the S&P 500 or Nifty 50.

Why they’re beginner-friendly:

- Diversified = lower risk

- Low fees

- Consistent historical returns

Popular platforms: Vanguard, Zerodha, Groww, Robinhood

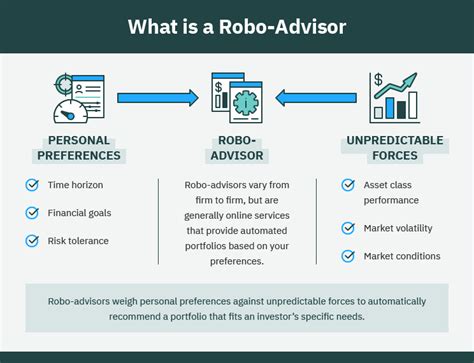

4. Use Robo-Advisors for Automated Investing

No time or expertise? Robo-advisors do the work for you.

You answer a few questions, and the platform builds and manages your portfolio using algorithms.

Benefits:

- Start with low amounts

- Automatic rebalancing

- Lower fees than traditional advisors

Try: Betterment, INDmoney, Wealthfront

5. Take Advantage of Retirement Accounts

The earlier you invest in retirement, the bigger your gains thanks to compounding.

Tax-saving accounts by country:

- USA: Roth IRA, 401(k)

- India: PPF, NPS

- UK: ISA

- Canada: RRSP, TFSA

Even $50/month invested early can turn into six figures by retirement.

6. Invest in Fractional Shares or SIPs

Don’t have thousands to invest? No problem.

With fractional shares, you can invest in big companies like Apple or Tesla with just a few dollars. In India, use Systematic Investment Plans (SIPs) to invest monthly in mutual funds.

Why it works:

- Builds consistency

- Removes market timing stress

- Great for tight budgets

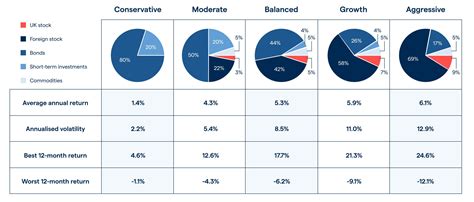

7. Diversify Across Asset Classes

Don’t put all your eggs in one basket.

Diversifying means spreading your money across different types of investments, so your portfolio doesn’t sink if one area crashes.

Mix of asset classes:

- Stocks & ETFs

- Bonds or debt funds

- Real estate

- Gold or commodities

- Crypto (in moderation)

8. Explore REITs (Real Estate Investment Trusts)

Want real estate exposure without buying a property? Try REITs.

These are companies that own or finance income-producing properties. You earn returns from rental income and appreciation—without the headache of being a landlord.

Benefits:

- Low capital needed

- Regular dividend income

- Traded like stocks (liquid)

9. Learn Before You Invest

Don’t invest blindly. Use 2025’s free tools and resources to build your confidence.

Learn from:

- YouTube (Pranjal Kamra, Rachana Ranade)

- Podcasts (BiggerPockets, The Money Guy Show)

- Books (Rich Dad Poor Dad, The Psychology of Money)

🎯 The more you know, the fewer mistakes you’ll make.

10. Stay Consistent and Think Long-Term

Forget quick wins. Think long-term. The key to building wealth is consistency—not luck.

Follow this mindset:

- Invest regularly (even in downturns)

- Don’t panic-sell

- Be patient. Let compounding work

⏳ “Time in the market beats timing the market.”

Bonus Tip: Avoid High Fees and Scams

High-fee advisors or too-good-to-be-true schemes can kill your returns.

Protect yourself:

- Use trusted platforms

- Stick with low-cost funds

- Don’t trust unregulated tips or influencers promising guaranteed gains